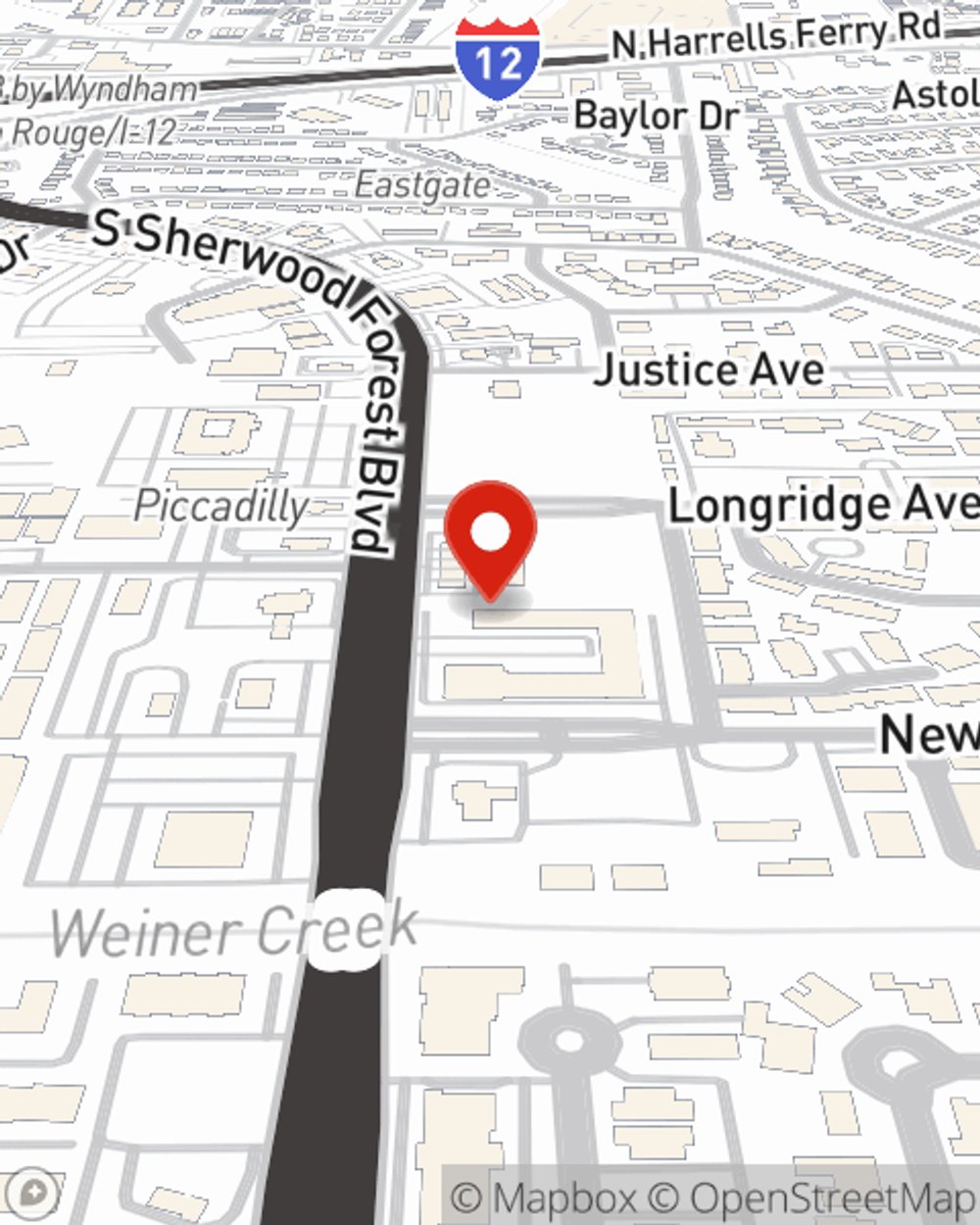

Business Insurance in and around Baton Rouge

Calling all small business owners of Baton Rouge!

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or problem. And you also want to care for any staff and customers who become injured on your property.

Calling all small business owners of Baton Rouge!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

Protecting your business from these potential catastrophes is as easy as choosing State Farm. With this small business insurance, agent Kelly Elkins can not only help you devise a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Take the next step of preparation and reach out to State Farm agent Kelly Elkins's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Kelly Elkins

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.